The lowdown.

What is an airport lounge access credit card?

An airport lounge access credit card offers complimentary or discounted entry to airport lounges, providing a more luxurious pre-flight experience. These lounges typically include amenities such as free food, drinks, Wi-Fi, and comfortable seating. Access is often provided through programs like Priority Pass, LoungeKey, or specific airline lounges like Qantas Club or Virgin Australia lounges. The extent of access and number of visits depends on the card’s features and terms.

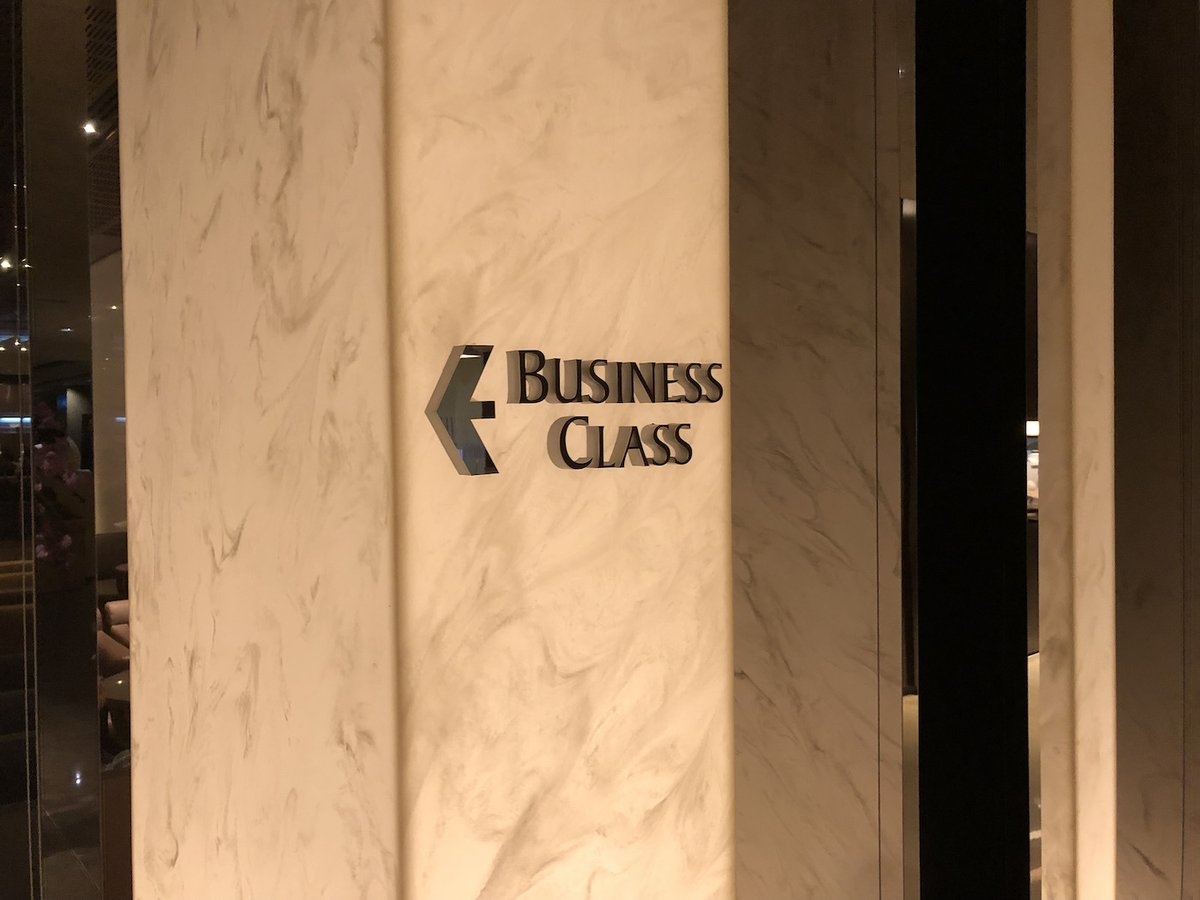

Changi Airport SilverKris Business Lounge

Image credit: David Boyd / CreditCardCompare.com.au

Key facilities you can expect in an airport lounge

For frequent flyers, the benefits of airport lounge access are significant. Restricted-entry airport lounges range from basic to luxuriously opulent.

At the lower end, your ‘lounge’ may be a bar or café in the ordinary passenger concourse, offering discounts on food and beverages to members (or single-entry pass holders) of specific lounge programs.

The most opulent lounges may offer luxuries such as spa treatments, five-star dining, and personal transport between the airline’s check-in desk, the lounge, and the boarding gate. In most lounges, you will find many of the following facilities:

- A dedicated working area with desks, device charging points, free Wi-Fi, and access to a computer if you don’t have your own.

- A ‘quiet area’.

- A screen with flight boarding information.

- Comfortable seating.

- Complimentary food and beverages.

- Complimentary newspapers and magazines.

- Showers with towels provided.

- TV and movies.

Expert opinion

How to choose the best airport lounge access credit card that suits you

Credit Card Compare co-founder, David Boyd explains the different things you should consider when selecting a credit card with airport lounge access.

You should gauge the lounge coverage (both domestically and internationally), ease of use (automatic access vs. requiring enrolment), and the value provided by additional perks such as rewards points or travel insurance. Cards that offer unlimited access and cover a wide range of lounges tend to be the most highly recommended for frequent travellers.

How much is complimentary airport lounge access worth?

The value of complimentary airport lounge access depends on the level of access your card provides, the quality of the lounge, and how often you travel.

Qantas lounges cater primarily to Qantas Club members ($399 to join plus $450 per year), passengers travelling in Qantas business or first class, and high-tier frequent flyers. These lounge access methods require high expenditure, making even two single-entry passes quite valuable.

Virgin Australia, Priority Pass, and Delta SkyClub have similar programs, with joining and annual membership fees granting unlimited access.

Access to Véloce World, American Express, and Diners Club lounges is limited to holders of specific credit cards, but the value obtained is comparable to programs with a joining and annual membership fee. For frequent travellers, membership in any program with unlimited lounge access is probably worth at least $500 annually.

Based on lounge programs that sell single-visit passes for guests or travellers on their linked airline, two single-visit passes are likely worth between $75 and $130 per year.

Business Class entrance at SilverKris lounge

Image credit: David Boyd / CreditCardCompare.com.au

What Australians think of airport lounge access cards

Australians generally appreciate the comfort and convenience offered by airport lounge access cards. For frequent flyers and business travellers, the ability to relax before a flight in a quieter, more comfortable environment is highly valued. But, there are quite a few who wonder if there is any value to free airport access.

For example, on Reddit a user said "I've been using the lounges a fair bit recently because I've been getting good flight offers. From what I'm hearing and seeing at the lounges, many of them are really crowded."

Another Reddit user replied with "Tbh it’s not really worth spending money on it atm, lounges have not been very pleasant lately"

However, for those who travel less frequently, the high annual fees of these cards can be a deterrent, especially if the lounge access is not fully utilised.

What to consider before applying for a credit card with airport lounge access

When applying for a credit card with airport lounge access, keep these points in mind:

Annual fees

Cards with lounge access typically have higher annual fees, but these can be offset by the lounge and other travel-related perks. There are cards with no annual fee for the first year, like the HSBC Platinum Credit Card.

Lounge networks

Consider which lounges you will have access to. Some cards offer access to specific airline lounges, while others provide global access through programs like Priority Pass or LoungeKey.

Eligibility conditions

Some cards require you to make specific purchases, such as booking a flight with a certain airline, to activate lounge benefits.

Visit limits

Many cards offer a limited number of lounge visits per year, while premium cards may offer unlimited access.

How to maximise your airport lounge access

To make the most of your credit card’s airport lounge access:

- Check availability. Before travelling, verify which lounges are accessible with your card at your departure airport. Some cards may require pre-registration with a lounge program like Priority Pass.

- Use passes strategically. If your card offers a limited number of passes, save them for long-haul or peak travel periods to maximise value.

- Leverage other perks. Many cards offering lounge access also come with other travel benefits such as cashback, free travel insurance or no foreign transaction fees.

Image credit: David Boyd / CreditCardCompare.com.au

Expert opinion

What mistake do people make most often with their credit card?

Andrew Boyd, co-founder of Credit Card Compare, explains the biggest mistake Australians make when taking advantage of their airport lounge access.

A common mistake travellers make is assuming that their lounge access is automatic. Many cards require you to register with a lounge access program, such as Priority Pass or LoungeKey, before you can use the benefits. Another easy oversight is not checking the conditions attached to lounge passes, such as needing to book flights with specific airlines or use the card for the booking.

Benefits of an airport lounge access credit card

- Comfort and convenience. Airport lounges provide a peaceful environment with free amenities such as food, drinks, and Wi-Fi, making travel more enjoyable.

- Cost savings. Lounge visits can cost up to $65 per person, so using a credit card with complimentary passes can result in significant savings, especially for frequent travellers.

- Additional travel perks. Many lounge access cards come with other benefits like travel insurance, rewards points, or no foreign transaction fees, making them a comprehensive travel tool.